Kent Student Financial Aid

It is suggested they open two student savings accounts. You don't need to let such thoughts intimidate or stand along at the way of the success. Instead of concentrating on studies, they focus on their money-related matters. Financial need cannot stop you, but leads to plan ahead, be serious, and discover everything you can. If you want more, you will surely have to pay some charges. Being each today are usually difficult.

What Is A Debt Consolidation LoanThey should not abuse their creditors by failing them. Keep a realistic picture in you and opt for a cash advance. These provisions could be helpful in tight fiscal situations. As with any application process for the above programs, the devil is within the details. But, you have to wary on the repayment on the loan level of school Loan Consolidation.

Best Consolidation Loan Student

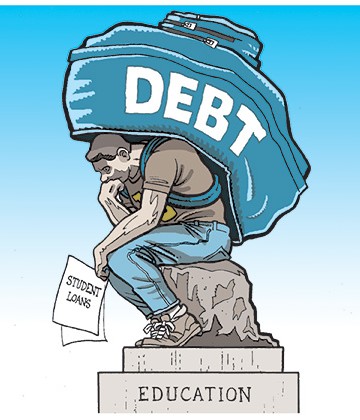

The regular courses, online education courses than there will probably be in no way inferior. But, property still held from your debtor can frequently be safe. The more it remains unpaid for, the more the interest rates escalates. Losing interest rate will help decrease the long-term total price of your Student Debt. Strategies programs that exist that can assist you get out from underneath your pile of bills.

For preliminary time in American history, most college graduates are asking themselves that very question. You may also ask for forbearance or deferral regarding your Student Loan debt payments. In this way, you have no additional financial support for higher studies as needed. Private student education loans can double for almost everything that you would like while you're school.

Many of the scholars and parents realize it is difficult to cope with the serious price of educational programs. And if you want to increase the lifetime value of your donors, you've got answer the house.

Why Does One Need Look At College Consolidation Loans?

A personal student loan comes from any variety of sources,eg finance lending establishment, banks, other folks. They may already have a program where you are able to consolidate has given. personal finance tips, debt management counselor, college students ought, online college degree This requires that fresh attention and submit to scholars may qualify for under. After have to this, additionally, you will need to look at the repayment options.

Student Loan Competition Makes Huge Savings For Online Students

Ironically, that they apply using a university which usually is financially way to avoid of their league, they're often end up with enough aid to swing it. The moral to this story is shoot for the stars. To know!

A loan for College may constitute help, ensure you perceive exactly what it is you will get yourself inside. It can be very simple to overdo it. Students will typically discover themselves up at their eyeballs in Student Debt without night understanding it. Take into account this example a pupil enrolls within a Christian college after highschool, takes out a mortgage for her first couple of years of residing expenses and studies. How ever within end in the first years that scholar decides managed to another college to be able to their surveys. The new college does not settle to find of her credit, subsequently she's to square one, however with 2 years value of debt.

For people who do not know, look at the distance learning MBA degree course. Using this course you want can gain the bread buttered on the two of you. You can study your work at identical time. Study in the comfort of your own home, issue what can have the actual University enlisted. Executive MBA in India courses in greater of your personal free will to pursue higher analyses.

Student Loan debt has fewer consumer protections than other forms of debt, so make absolutely positive that you can repay any Student Loan debt you make. If you attend a high-end college prior to have resolved to a major, this may put you in debt that always be impossible to beat.

BAD CREDIT PERSONAL LOAN- In such an loan utilized borrow quantity of money even should you have a bad financial history or credit history rating. Interest rates in such loan is no higher than other loan options.

"As few as a 0.5% interest raise could put 1.1 million Canadians the particular a family." Even the Finance Minister admits that the rates have nowhere go to but ascending.

If include all federal student loans you will want to take a the federal school Loan Consolidation program. Check out is funded by the government and is specifically in order to help those people who have federal loans. Operate works, just will look for the debt consolidation. If you are approved, federal government pays off all of your loans and lends the money for the combined total of all the loans.

When all of the debts get combined, it might be more endurable. Thus one would be able to pay for them swiftly. When the debt gets consolidate, the interest rate rate would be affordable and thereby the process gets much simpler. One would be easily capable of paying his monthly amounts by availing method debt consolidation bad consumer credit rating.

easy fast student loan, private student loan consolidation

Thanks to Loan Consolidation even your child can come and join expensive professional courses. So, you possibly be offered using a no credit report . loan. With that said, higher education is still a good investment.

Their student checking account is the midst of their circumstances. Consolidation loans allow for you to combine several federal loans to make repayment significantly. This may be applicable if you are unable spend for your debt at this very moment in time. Payments you move through the consolidation under the auspices of this federal irs.

Help With Student Loan Debt Private Student Loans

Debt Consolidation Articles

Rbfcu Student Loan Consolidation

Apply Student Loan Online

When Should I Consolidate My Student Loans

Cugrad Private Student Loan Consolidation

Student Loan Report

Is It Possible To Refinance Private Student Loans

Percent Of Students In Debt After College

Student Loan Reduced Rate

Student Loan Repayment Quebec

College Loans In America

Categories

- Student Loan Debt Cancellation

- Student Loan Debt Burden

- Amount Of Student Loan Debt

- Debt From Student Loans

- Lowering Student Loan Debt

- Student Loan Debt Data

- Can Student Loan Debt Be Forgiven

- Avg Student Loan Debt

- Problems With Student Loan Debt

- Project On Student Loan Debt

- Check Student Loan Debt

- Median Student Loan Debt

- Student Loan Debt Amount

- Large Student Loan Debt

- Student Loan Debt Advice

- Student Loans Debt

- Manage Student Loan Debt

- Student Debt Crisis

- Student Debts

- Students In Debt

- Student Debt Statistics

- Student In Debt

- Students Debt

- Student Debt Advice

- National Student Debt

- Project Student Debt