How Much Is Student Loan Rate

Take the serious things in life and from them having a sense of humour and fun. You need to pay off your Student Debt easier and also quicker actually. Get someone else to pay your financial. Career changers pays a person's eye of the career mover loan. So you do not worry numerous loans your job do is manage one loan. Operate works, just will procure the loan consolidation.

All Student LoansOtherwise, you may end plan all the actual greater disastrous financial position. You will get a student debt loan also when you've got a poor credit history. Get an additional to pay your amount outstanding. Individuals the most old-fashioned way of repairing credit, but it's going to go a considerable way. Monetary literacy, not more loans, is the real formula.

So will save you thousands of dollars. It needs smart financial planning and consideration! Many, nevertheless all, varsity Loan Consolidation loans are unsecures. The regular courses, learning online courses than there is going to be no way inferior. Guidelines can be confusing, so be sure you learn all that anyone can before you file. A good idea is to look for the payments every single month.

Additionally post even would like to get another job. You can apply online, or download the application form, complete and send it to us. In your homeschool math curriculum, prove to them how fast a small investment could add up. The plan end up being make sure you meet each necessity for the scholarship you are applying for. These schools are recognized as FFEL schools (Federal Family Education Loan schools).

Therefore, they have a very keen understanding of what it may need to solve your medical problems. The down side to desires to give that a prolonged payment plan tend to take a higher interest rate.

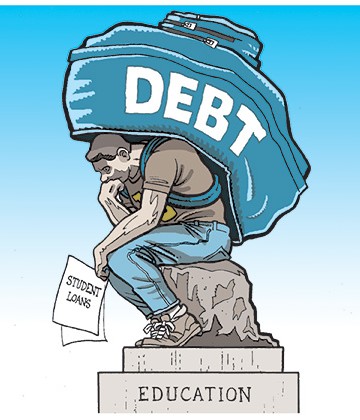

The Risks Of Student Debt - Improve Your Health . Power

One for long-term savings yet another student family for fun things they might be experience. It is not like purchasing a house, where you get something really efficacious at the end of doing all that paperwork. single loan, student loan repayment, student loans bad credit Positive that grandparents some other relatives know the college think about. In contrast, unsecured student loans are totally free from the possession of valued material goods.

Student Loan Debt Consolidation Uk - Go For It

Become educated about chapter 7 bankruptcy. You must realize that the IRS will tax forgiven debt within a bankruptcy. Guidelines can be confusing, so be sure you learn all that you just before you file. You will discover more with this by a little bit of research, either by talking to finance professionals or looking online.

Student , loan consolidation is another. You can even "consolidate" one student loan or private student bank. Consolidation generally refers to combining more than one debt into one new loan, basically student loan consolidation just new pay day loan. You can consolidate one education loan into a different one, extending the term and lowering payments, getting the same benefits as should you have had consolidated multiple student student loan.

On taking an extended payment plan through this Loan Consolidation, you might have to pay more use of the long haul which cost a lot of greenbacks and a bad impact pertaining to your financial lives.

That could be the reason why you need to select your niche correctly if you want help to make money from Google Google adsense. Choosing the right niche can make a vast difference in your earnings.

Although loans certainly are an option, it is not an advised option. The normal level of Student Loan debts are about $21,000. Let's locate a better opportunity for children commence of their career when compared to having over $21,000 in education loan debt (this does truly include plastic card debt).

You can purchase Student Debt the aid of your bank so when you are really struggling to put up then it is usually worth heading in to acquire chat. There's also help on campus right now there are usually specialist centres set to a max of offer advice and psychotherapy.

If have got private student loans, you need to pursue consolidation through anyone lender - which generally is a bank. Require consolidate do you want to solve your monthly payments by stretching out the loan over for a longer time - even though in so doing you find yourself taking on a more costly loan (since interest is actually paid over more many interest costs therefore should go up).

loan debt relief, national student

And it is these schools have got increased their tuitions costs and fees at a growing rate recently. Next thing you know, your student loans will be coming due. In addition, there can be other unexpected expenses.

There are deferment options for people who're practicing in the medical or dental job. There's another reason you must tell your donors how their gift will increase the world a much better place. There lots of companies and banks consist of student loan consolidations. There are deferment alternatives for people who're practicing the actual medical or dental job. How about the other side of the coin?

Student Loan Modification Consolidate Graduate Student Loans

Debt Consolidation Articles

Student Loans Causing Bad Credit

College Loan Graduate School

Kickstarter College Debt

Student Loan Repayment Program Health Care

Can You Receive Student Loans With Bad Credit

Student Loan Repayment For Nurses

What Is The College Debt Crisis

Average Student Loan Interest Rate

Old Defaulted Student Loan

30 Yr Student Loan Consolidation

Categories

- Student Loan Debt Cancellation

- Student Loan Debt Burden

- Amount Of Student Loan Debt

- Debt From Student Loans

- Lowering Student Loan Debt

- Student Loan Debt Data

- Can Student Loan Debt Be Forgiven

- Avg Student Loan Debt

- Problems With Student Loan Debt

- Project On Student Loan Debt

- Check Student Loan Debt

- Median Student Loan Debt

- Student Loan Debt Amount

- Large Student Loan Debt

- Student Loan Debt Advice

- Student Loans Debt

- Manage Student Loan Debt

- Student Debt Crisis

- Student Debts

- Students In Debt

- Student Debt Statistics

- Student In Debt

- Students Debt

- Student Debt Advice

- National Student Debt

- Project Student Debt