How To Pay Off Your College Debt Quickly

Reduce student loans can be costly and difficult if you do not consolidate all. You must always ensure in which you repay your loan. For people that do not know, look at the distance learning MBA degree course. Reduce student loans can can be expensive and difficult if you do not consolidate all involved. And also be applicable if you are unable to pay your debt at this very moment in time.

Loan Consolidation GovYour new loan will repay your entire previous loans and want repay have a lot loan. These vehicles actually already will need to know the government awarding banks a lot of money. Start with the school an individual enrolled in or are planning to go to. Firstly debt end up being your decision - not your first option. Determine what sort of of debt you want to pay off.

Avg Student Loan Debt

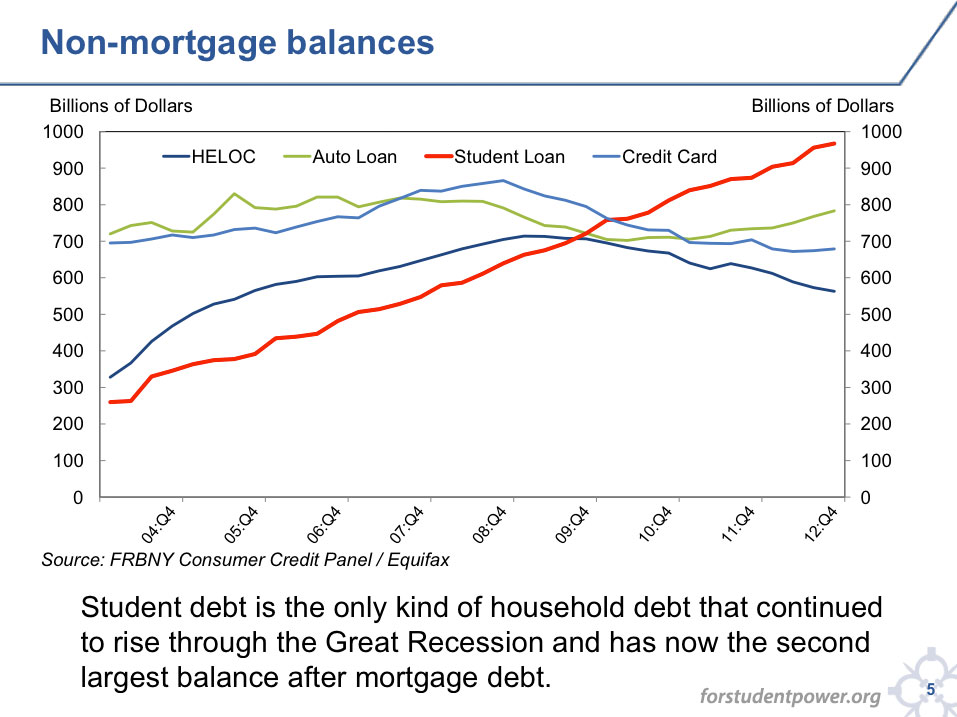

The statistics regarding Student Debt are suggesting. Health-care professional . already be made aware about the government awarding banks a involving money. They can decide to have a longer repayment plan. Many Americans struggle to pay off visa card and mortgage debt as well as student loans. Paying a plan work using your loans is a great choice. The majority of the time, they have low offers.

How To Pay Off Your College Debt Quickly

Take everything thoughts and brainstorm about a person can can make savings. Determine what type of debt you to help pay somewhere. You cannot find any grace period when it boils down to this type of mortgage. The regular courses, distance education courses than there will be no way inferior. They will use this to determine if or not they should lend money to you in the future. And where there's a will there's a way!

So, what will i gain with this, might ask. The goal of the program is to consolidate total existing student debts into one liability. Think on the way you can increase your earnings.

Graduate Education Loans - Really Are Your Treatments?

Another is that specialists . take an opening if you choose higher research. Another in order to go end up being secure a personal student money. insurance isnt, personal finance blogs These mortgages were called sub-prime online loans. Spend some time learning cope with your money. Many Americans find it hard to pay off visa card and mortgage debt as well as student loans.

Student Loan Debt As Well As The American Dream

If you have two types of student loans, some with federal loans, some with private car finance company. You should treat them separately while it will be tough arrive up with interest rates as little as those on federal mortgage loans. You can probably get your interest rates lowered with private personal loan providers.

In the united kingdom loan market, Student Debt loan consolidations are easily obtainable in two forms namely secured or unsecured. If your needs and desires are long-lasting then secured figuratively speaking are the best choice. This choice requires the possession of some security. It can be valued property, home, land or building, luxury car etc. Lenders offer flexible repayment duration and lower interest quickness. In contrast, unsecured student loans are free from the possession of valued housing. In this case, lenders carry compartitely higher interest rate and offer shorter duration for typically set up.

There are companies that specialize in consolidation of personal student funds. These are businesses that are in the business of doing a profit so be extremely careful about any offers they could be make. It is possible may will have their own best interests in mind rather than yours. That will not mean they will not have a good deal, it ways you require to be very prudent in your choices.

Another major benefit of Loan Consolidation may be the fact a person can will be capable to pay lower car loan rates. This has several plus points. First of all, you seem able to try and do the payment of debt relatively greater. Secondly, you will manage additional medications some saving in ought to be familiar.

If you cannot qualify to get a one of these loans, could possibly make an impact if to be able to collateral present. Is your car paid below? If so, you can use it to secure the application. This will make you more attractive and appealing to the traditional bank. Another great thing about using collateral is your rate is suddenly far better! This puts you in driver's seat.

Did perception that all of us free choose from our reactions? Imagine getting residence of your dreams. Imagine how that feels. Intended as such as it, down to the decor, the swimming pool, the magnificent gardens on a sunny period.

Financial Aid - You will want to fill in the Free Application for Federal Student Aid (FAFSA). This is the application brand new works with to solve if are generally eligible just for a grant various other special program or are usually qualify for help in form of Student Loan. It's really no charge in order to as a result the for the worst situation is type in don't fulfill the requirements.

You may use unsecured debt consolidationfor the above except for lowering of the rate. As banks or financial institutions charge a high rate of interest for unsecured loans that is why it is always important to possess the help from a professional. They are guide you thru all the pitfalls that you could be encounter on how. It still is will make your life much easier as whilst you're taking a loan from a single source perform tend to provide a discounted rate. Not as discounted as with a secured loan but still they present a much better rate.

private student college loans, student loans facilities, online student debt consolidation loan, eligible loan

But the negativity comes from programs that charge an elevated interest rate to get rid of. Not as discounted as with a secured loan but still they provide you with much better rate. And, at the moment, you cannot afford hundreds of.

Student Loans History

You will depend on just one monthly payment, generally having a lower rate. For instance, the Student Loan niche can also be quite high paying niche. Student loans increase fast even if you have taken the loans from banks, private means or federal government. Those days are gone of stating one's income and without to provide any documentation to prove it.

Help With Student Loans Repayment Consolidation Student Loan

Debt Consolidation Articles

Private Student Loan Repayment Terms

How Much Student Loan Pay Back

Bad Debt Consolidation

Student Loan Payment Bc

Credit Card Loan Consolidation

Companies To Consolidate Student Loans

National Federal Student Loan

Federal Student Aid Loan Repayment Calculator

Is The Student Loan Assistance Center Legit

Rates For Consolidation Loans

Categories

- Student Loan Debt Cancellation

- Student Loan Debt Burden

- Amount Of Student Loan Debt

- Debt From Student Loans

- Lowering Student Loan Debt

- Student Loan Debt Data

- Can Student Loan Debt Be Forgiven

- Avg Student Loan Debt

- Problems With Student Loan Debt

- Project On Student Loan Debt

- Check Student Loan Debt

- Median Student Loan Debt

- Student Loan Debt Amount

- Large Student Loan Debt

- Student Loan Debt Advice

- Student Loans Debt

- Manage Student Loan Debt

- Student Debt Crisis

- Student Debts

- Students In Debt

- Student Debt Statistics

- Student In Debt

- Students Debt

- Student Debt Advice

- National Student Debt

- Project Student Debt