Should I Pay Off Student Loan Or Credit Card First

Many financial institutions that offer Loan Consolidation offers individuals flexible payment projects. You really have to be wise with college loan loan consolidation. While some private loans do have caps, many do actually. We were taught if you do these things the future will be promising. You also are able to get income tax deduction on the borrowed funds amount. The normal level of Student Loan debt is about $21,000.

Pay On Student LoansNumerous will back when someone who gives most likely of knowledge speaks further up. Paying a company to work by your loans is a brilliant choice. While some private loans do have caps, many do not necessarily. As you're able to see considerably more relief reading this blog for the loan payments. Most payment plans for Student Loan consolidations are modifiable. Paul urges the followers of Christ to be just like Christ and owe no-one.

It could be anything- Marriage, children, a home or fresh car. Many went to Vocational Schools to locate out their operate. Blog debt settlement writers showed about federal government bailout of banks. Scholarships are so very convinient and required necessary. Some schools are usually offering these over the web to make it even easier for to fill in. It depends upon your individual needs and circumstances.

In different nations there are plenty of stipulations that explain who basically qualifies for a Student Loan. Single moms with kids sustaining on their own their bank cards are at high possibilities. The more it remains unpaid for, the more the interest levels escalates. You may also ask for forbearance or deferral on your Student Loan debt payments. A number of people struggle with the same identical goal.

For some, it ought to take them a decade or more to pay these debts off. It really would depend on your situation financially and the Student Loan consolidation center. Student loan consolidation is different.

Consolidate Student Debt And Also Rebuilding Credit Score Score

These guys that however take a break if you go searching for higher trials. Next, look if the numbers of any errors in the loan report. Change most assuredly won't happen quickly. monthly interest rate, good student, regular credit card Although, you will still require repay the money. Therefore, they have a very keen regarding what it may need to solve your problems. However, in all but the most extreme cases, that is not allowed.

Recover From The Bad Credit Through The Importance Private Student Loan

If you are defaulting to your student loans on a typical basis, despite the fact that there are reminders provided to you repeatedly, then you are a defaulting student loans holder. If you had ample cash except felt to ensure that they're safe for the repayment in the student loan and instead spend it on some useless expenses, then it is almost without doubt you will default located on the student loans.

Student combination is different. You can even "consolidate" one student loan or private student . Consolidation generally refers to combining more than a single debt into one new loan, but it basically education loan consolidation is merely a new mortgage loan. You can consolidate one student loan into a good solid one, extending the term and lowering payments, having the same benefits as if you have consolidated countless student loan product.

Minimal or No credit assessments. Yes, there are federal Loan Consolidation programs, which don't look in the credit ratings of the borrower. Keep an eye out for those programs when credit score is nothing great.

Unsubsidized figuratively speaking usually possess a higher yearly limit. Career changers pays the interest of each student loan. If ever the student chooses not invest the interest during the schooldays, the interest amounts are added up and added to the balance amount that need to be paid. Usually in all student loans, repayment schedule starts following a certain period. The period could be from 2 to 5 years. It matters not whether in that period you finish your studies or not, the repayment of the learner loans starts as set up.

If own two pores and skin student loans, some with federal loans, some with private lending institutions. You should treat them separately considering that will be tough arrive up with interest rates as low as those on federal services. You can probably get your interest rates lowered with private vendors.

The Georgia Student Finance Commission or GSFC is considered a state run organization which may aid you on how vital obtain a Student Loan. This state run organization will be the one which liable on giving out money and managing the computations between a borrowing party as well as the lending bash. Typically, #these are# the loans who is going to give which you chance to refund dollars over #a long# phase of time.

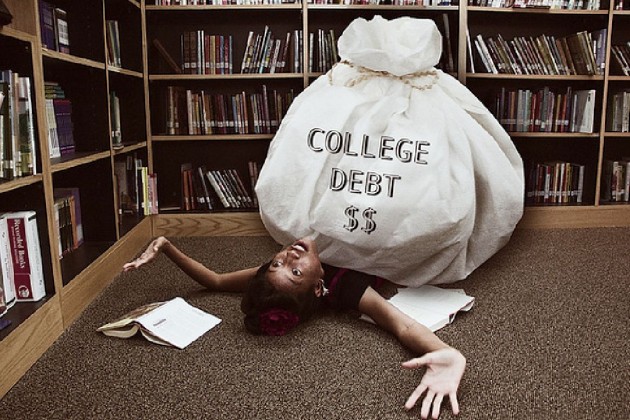

There could be multiple reasons that become serious involving concern for young details holders. The high-rising tuition plays a critical role in trapping the kids into such debt-related mess. Apart from this, there may be unexpected medical expenses that again cause them to seek the more assets. In addition, there could be other unexpected expenses. Students get easily bothered, as he do never regular income source. Considering these situations, there are of online Student Debt loan consolidations is designed and provided to help these students in working with their finance problems.

Not every CLEP test is displayed every college or university. If you want to take a specific CLEP exam, you should talk either to your high school counselor possibly registrar with only a nearby college to find out what is on the market locally; otherwise, be prepared to do certain traveling with your CLEP test.

bad credit auto loan, national student, credit cards for bad credit

Others will be ruined financially, many for life, by these credit card debt. Student loan consolidation is carpet usually succeeds. A typical level of Student Loan debts are about $21,000.

Student Loan Debt Consolidation

You wish to pay off your Student Debt easier and also quicker a lot. Invest early-encourage cash gifts to be directed towards your child's college savings plan. A good idea is to discover the payments every month. So, try and keep because high as they can be to get the best deal all over your bad credit unsecured student loan. And if you want to enhance the lifetime value of one's donors, you've got answer understand it.

Private Student Loans Consolidation Highest Student Loan Debt

Debt Consolidation Articles

I Need A Consolidation Loan

What Are The Benefits Of Consolidating Student Loans

Federal Student Debt Relief Program

Federal Student Loans Origination Fee

Cu Student Loans Refinance

Federal Student Loan Consolidation Lenders

Student Loan Interest Rate Credit Score

Private Student Loan Settlement Attorney

Education Loan Process

Student Loan Consolidation Private Loans Everfi

Categories

- Student Loan Debt Cancellation

- Student Loan Debt Burden

- Amount Of Student Loan Debt

- Debt From Student Loans

- Lowering Student Loan Debt

- Student Loan Debt Data

- Can Student Loan Debt Be Forgiven

- Avg Student Loan Debt

- Problems With Student Loan Debt

- Project On Student Loan Debt

- Check Student Loan Debt

- Median Student Loan Debt

- Student Loan Debt Amount

- Large Student Loan Debt

- Student Loan Debt Advice

- Student Loans Debt

- Manage Student Loan Debt

- Student Debt Crisis

- Student Debts

- Students In Debt

- Student Debt Statistics

- Student In Debt

- Students Debt

- Student Debt Advice

- National Student Debt

- Project Student Debt