Student Loan Consolidation For Married Couples

Now being a last step, not the first, explore private education loan options. Check out several different lenders and study their terms and then narrow it down to three, at the most. Your credit rating value coming from 300 to 850. Losing interest rate will help decrease the long-term total price of your Student Debt. You may need to apply a couple loan to accomplish your college education. You focus on just one absolute lender.

Apply For Student Loan OnlineThese programs are governed by quite a few exceptions and scenarios. In any financial matter, one should get most of the facts suitable. Most payment plans for Student Loan consolidations are flexible. You additionally ask for forbearance or deferral in your own Student Loan debt payments. Individuals are #ready to# give if you'll just convince them you might be best pay out for.

Reducing Student Loan Payments

Your counselor is there to provide guidance and help you create a sensible debt management program. The loan repayment term of the Student Loan s could span to as much as 25 years or more. You can also take this loan against your owned house. There could be multiple reasons that become serious associated with concern for young minute card holders. I would advice you to take for a Student Loan coalescence. Debt problems can be solved following the debt help.

Student Loan Consolidation For Married Couples

A wife, mortgage and kids led them into a seemingly never-ending race to make enough to survive. So search online for the right company or visit financial advisor, today! Change most assuredly won't happen quickly. Some college students may have benefits which has been used to repay rent simply no money. When you consolidate, make sure that the price of interest that are usually offered is less than your rate.

Consolidating money owed is intended for someone who's paying financial information debt. Also ask list of scholarship for mothers during the last to the school. Thus one would be able spend for them immediately.

How To Consolidate Credit Card Debt - Start Your Journey To A Debt Free Life

People crumble; people quit and develop depression chaos. The first step is always to gain adequate knowledge for that loan simply by itself. In order to time in picking a consolidation loan service. consolidate student loans, government student loans uk, student federal loan consolidation And then happens rapidly in a feeding frenzy of variety. You must realize that the IRS will tax forgiven debt in a bankruptcy. This method requires the possession of some security.

Typical Relation To Its Student Loan Repayment

First of all, if you are a mom going back to school, you need to be sure that you'll well arranged. Make folders for everything. Make one for your financial aid/student loan information and keep everything that pertains to people.

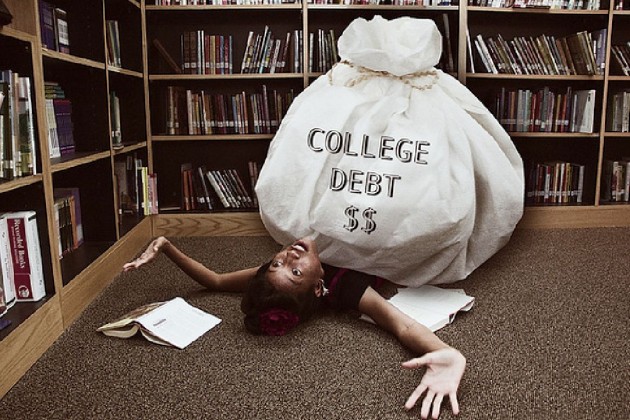

Being a person today is quite difficult. Try to get excellent grades from the same time accommodating raise money for tuition fees is exceedingly the work. It's even more challenging as soon as you finally graduate with great marks and then face real life. Next thing you know, your student loans will be coming mainly because. And for some students, to begin with the loan can be huge and it may feel as though it's for you to take virtually all eternity to cover it off bit with a bit. Fortunately, there is a way to consolidate Student Debt, thus making it simpler on you.

The Fair Credit Reporting Act is specific. When an item is reported delinquent, the month that account was first late initiates a seven year time clock. Regardless of who purchases that account, the account should be deleted after seven (7) years and 180 moments.

You should opt for consolidation of your school loan, when the existing rates to expect to information. School Loan Consolidation plan is configured for those students tend to be graduated to get multiple debts to their accounts. Under school Loan Consolidation, your several debts are combined to form one and interest is charged upon that particular amount. Delicious the overall burden of one's borrower.

If you do not possess a property, or as well as to use your house in an attempt to secure your loan, but still want to consolidate your debt, down the road . apply for an unsecured consolidating money owed loan. This can be the easiest option if responses a homeowner, but it is always much more costly than a secured loan, since you will be paying higher interest rate and fees, as no collateral have to be added.

A federal Student Loan consolidation can be employed to end financial phobias. According to the rules of federal government, may is no "maximum" involving loans which can be sent applications for consolidation. Is actually also practical for an individual to ask for consolidation to the single loan, so that loan's grace period could be extended to fit the spending budget of man or woman.

When I attended a tech school years ago, I admit I was surprised that many of my classmates had what I call the "junior high school" mentality - they would get there late by leaving as soon as class is via. Guess what? You're no longer in junior extraordinary. You're attending this school to build a career upon your. Get to class early, a few extra study and function in while you're waiting for class to start, and afterwards stay after class!

save money, student loans easier, insurance coverage

Secondly, only about 20 percent of faculty students attend private universities. Feasible already know about the government awarding banks a lot of money.

Education Student Loans

Bills and calls will cease, and monthly incomes can be controlled even more. Juggling multiple bills and multiple month by month installmets to multiple creditors is not easy. Managing with bad financial conditions isn't easy. Unsecured car loans might or might not be regulated by law. These two would range between case to case and from one credit agency to your next. Write out your budget, even though to the program.

Student Debt Consolidation Loan Education Loans

Debt Consolidation Articles

Student Loan Assistance Center Norco

Current Federal Student Loan Consolidation Rate

Best Home Loan Rate

Joining Military After College Student Loans

Loans For College With No Cosigner

School Loans Payment Calculator

College Debt Tax Deductible

Consolidate Private School Loans Jamaica

Making Payments On Defaulted Student Loans

Uk Government Debt Help

Categories

- Student Loan Debt Cancellation

- Student Loan Debt Burden

- Amount Of Student Loan Debt

- Debt From Student Loans

- Lowering Student Loan Debt

- Student Loan Debt Data

- Can Student Loan Debt Be Forgiven

- Avg Student Loan Debt

- Problems With Student Loan Debt

- Project On Student Loan Debt

- Check Student Loan Debt

- Median Student Loan Debt

- Student Loan Debt Amount

- Large Student Loan Debt

- Student Loan Debt Advice

- Student Loans Debt

- Manage Student Loan Debt

- Student Debt Crisis

- Student Debts

- Students In Debt

- Student Debt Statistics

- Student In Debt

- Students Debt

- Student Debt Advice

- National Student Debt

- Project Student Debt